Integration of ESG criteria with financial performance

At the origin of the first SRI (Socially Responsible Investment) concepts in Switzerland, the management of BBGI Group has always been sensitive to the theme of sustainable finance.

Today, the SRI market is growing rapidly, the result of a renewed interest from institutional investors, but also, increasingly, from private investors. The Eurosif Institute, which publishes every two years a complete study on the segment, thus reported a + 42% increase in the amounts invested in the various SRI strategies in Europe between 2013 and 2015.

BBGI ESG Swiss Equities Indices

The BBGI ESG Swiss Equities indices and dedicated mandates reflect our commitment to an outperforming product offering consistent with environmental, social and governance (ESG) concerns.

Designed to be transparent, quantifiable and accessible, the BBGI ESG Swiss Equities indices are based on a limited number of relevant criteria, based on generally accepted ESG principles.

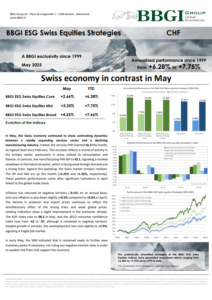

The systemically diversified strategies of the BBGI ESG Swiss Equities Indices have generated annualized returns ranging from +6.28% to +7.75% since 1999 to date.

Swiss economy in contrast in May

In May, the Swiss economy continued to show contrasting dynamics between a rapidly expanding services sector and a declining manufacturing industry. Indeed, the services PMI reached 56.3 this month, its highest level since February. This increase reflects a revival of activity in […]

Don’t miss out to discover our full article by clicking on the button below:

If you wish to access our archives, please click on the button below

To make sure you don’t miss any of our publications and have access to exclusive research, don’t hesitate to click on the button below to join our Newsletter!

Why the BBGI ESG Swiss Equities indices?

A relevant and performing comparison tool for your socially responsible investments (SRI)

BBGI ESG Swiss Equities Core Index – The biggest 20 Swiss companies

BBGI ESG Swiss Equities Mid Index – 40 Swiss companies.

BBGI ESG Swiss Equities Broad Index – 60 Swiss companies.

Dedicated mandates to invest in compliance with the principles of sustainability

The exclusive BBGI ESG methodology is available through dedicated management mandates. If desired, they can replicate the performance of the BBGI ESG Swiss Equities indices, or incorporate a tailor-made methodology depending on the sensitivities of the investor or the Board of Trustees.

In all cases, the exercise of voting rights is included for free in our management mandates for institutional clients and is an integral part of our socially responsible management.

An accessible and proven ESG method

The ESG methodology applied in the BBGI ESG indices is based on a limited number of quantifiable criteria. Each company is given an ESG rating based on its position in the industry.

By investing in a more sustainable way, investors benefit from two-sided added value

In terms of environmental, social and governance concerns, BBGI ESG Swiss Equities indices and mandates significantly reduce the ESG risk of their exposure to Swiss equities. In terms of performance, our indices and mandates have been optimized to improve investment diversification and risk diversification.

The integration of ESG criteria into the traditional financial analysis, as practiced in the BBGI ESG Swiss Equities indices, allows a long-term outperformance compared to traditional Swiss market indices, for a similar level of volatility.

Your advantages

31.12.1999 - 31.05.2025 Performances

Total return performance, in %

Annualized performance, in %

Press Articles (in French)

Bloomberg

BBGIESGC: BBGI ESG Swiss Equities Core Index

BBGIESGM: BBGI ESG Swiss Equities Mid Index

BBGIESGB: BBGI ESG Swiss Equities Broad Index