Time-tested Strategy

Our management philosophy is reflected in our logo: the bear and the bull, a symbol of constant adaptation to different financial cycles.

No single investment strategy works all of the time. We need to adapt investment policy to the different economic cycles, whether they be bullish (up) or bearish (down). This optimizes growth of our clients’ assets and preservation of their capital.

- Daily monitoring of risks and opportunities

- Tool for tactical risk and quantitative management dashboard

- Decisions taken by the Investment Committee

- Impeccable quality and transparency in our investment products

Concepts adapted to different phases of economic and financial cycles

An effective management process must take into account changes in the cycle over time, in order to exploit increases and avoid declines.

In the face of the turmoil which has swept across financial markets over the last few years, investors are more actively seeking wealth managers with skills that add value in the different phases of the economic and financial cycle. Our investment strategy is specifically crafted to exploit long-term gain in markets in periods of growth and, at the same time, to implement truly active risk management which limits the probability of market losses during periods of economic uncertainty.

Our active processes encourage decision making and are systematically buffered by trajectory procedures for better risk management.

Risks associated with active management decisions are managed through systematic use of methods that dynamically manage positions on several levels, because only immediate trajectory control allows you to act and react as quickly as possible.

Although risk management is often applied through measures such as tracking error (risk relative to the benchmark index), we have always believed that it is essential to use an active control system in order to be able to truly control the trajectory.

Indeed, it is only possible to add value through active management deviations. The consequences of these decisions must be analyzed and closely monitored to ensure that the trajectory evolves as expected. It is also important to have a clear corrective action policy should the trajectory move off-course in order to limit the negative effects of less well-performing investment decisions. These different measures form an integral part of our investment process and contribute to effective management.

Risk management

Allocation

- Active allocation based on risk outperforms buy and hold strategies

- A unique, anti-cyclical approach that enhances asset protection

- Active management, provides high-level performance whilst avoiding extreme allocations

Management

- Daily Investment Committee Meetings

- Complete daily analysis risk tool, backing up our judgment and rigor

- Daily comparison of risk analysis and fundamental analysis

- Anticipation and identification of risk (ex-ante versus ex-post)

- The Daily Risk Analyzer, a proven quantitative model used for over 12 years

Product selection

- Security, liquidity and transparency of products used, and direct investments

- A “best in class” approach for the selection of investment products

- No derivatives or hedge funds unless requested by the client

Independent active management

Our independent judgment is based on our own analysis of macroeconomic and financial factors and on the input of independent external sources selected for their high quality analysis within their specific fields.

This analysis leads to an investment strategy which is generally set out in relation to long term asset allocation or a benchmark index.

The effects, positive or negative, in terms of absolute or relative performance, are estimated in order to anticipate and control the active risk inherent to the implemented strategy. Methods for dynamic and rigorous management of positions pave the way for profitable operations and limitation of losses where necessary.

90%

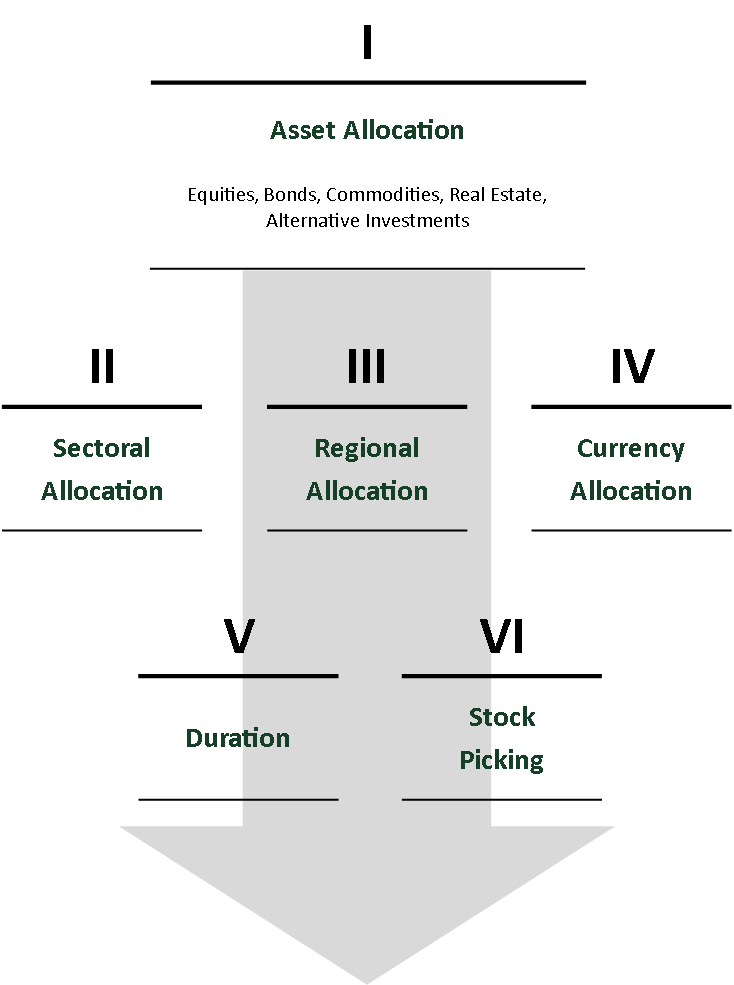

Asset allocation management and key parameters generate 90% of returns

Asset allocation is but the first parameter that influences the risk/reward of a diversified investment strategy. Our investment process analyzes other significant parameters that define our investment strategy, each of which can both be a source of profit and of risk; these are the key parameters we focus on