An efficient, diversified index

This benchmark index is targeted at investors wanting to observe or get involved in the positive development of the renewable energies sector to optimum effect. Since 2008, it has been mirrored by the Swiss registered investment fund BBGI Clean Energy Fund.

By creating one of the first broadly diversified funds in alternative energies, as well as one of the first Swiss-registered funds in this sector, BBGI Group offers a better overview of the alternative energies market and offers investors a high-performing investment vehicle as compared to others on the international stage.

BBGI Clean Energy 100 Index

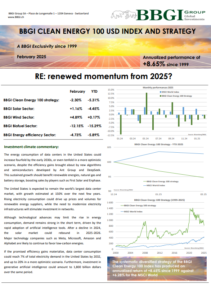

A systematic diversified strategy that has produced an annualized return of +8.65% since 1999.

RE: renewed momentum from 2025?

The energy consumption of data centers in the United States could increase fourfold by the early 2030s, or even tenfold in a more optimistic scenario, despite the efficiency gains brought about by new algorithms and semiconductors developed by Ant Group and DeepSeek. This sustained growth should benefit renewable energies, natural gas and […]

Don’t miss out to discover our full article by clicking on the button below:

If you wish to access our archives, please click on the button below

To make sure you don’t miss any of our publications and have access to exclusive research, don’t hesitate to click on the button below to join our Newsletter!

Composition

The BBGI Clean Energy 100 index and the indexed investment fund linked to it are made up of 100 equally weighted securities from companies specialized in alternative energy. The nuclear sector, which is sometimes considered a form of alternative energy, was not one of the sectors chosen when the index was created.

It is composed of companies developing innovative technological processes in the production, transmission and storage of energy, in the following sectors:

- Solar

- Wind

- Biofuels

- Energy efficiency, storage, hydrogen, etc…

We take special care to diversify the fund in terms of sector, geography and currency.

The BBGI Clean Energy 100 index has comfortably outperformed the other indices available since their creation and has the longest track record in the sector.

Invest in a sector of the future, through a diversified strategy

Alternative energies are the only way out of the oil impasse.