23

Dec

Attractive valuations for European equities

Recession likely in early 2023 in Europe. Confidence still at half mast. First sign of falling inflation. ECB becomes more aggressive. The rise in yields is not over. Rise in the euro. Attractive PE for equities.

Key points

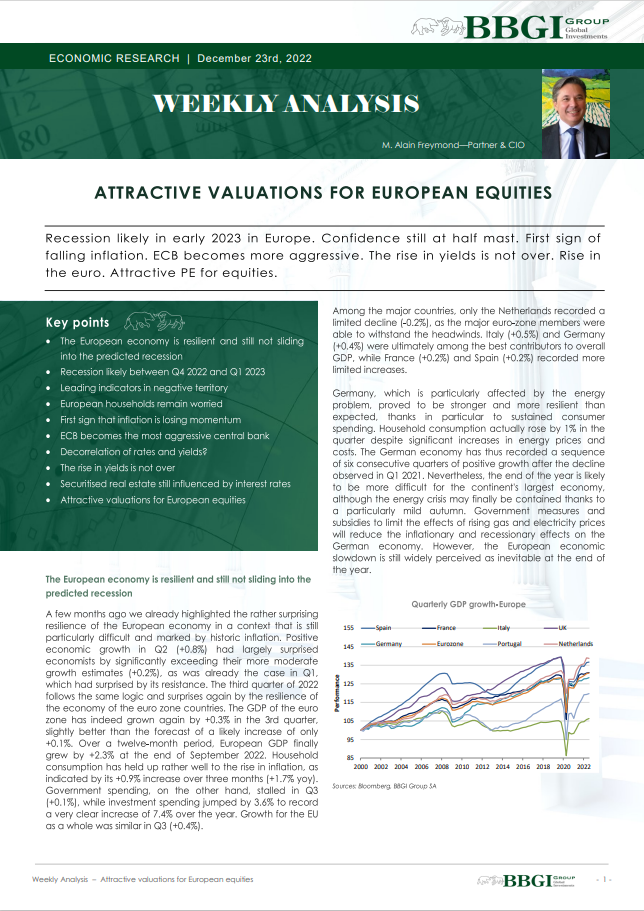

- The European economy is resilient and still not sliding into the predicted recession

- Recession likely between Q4 2022 and Q1 2023

- Leading indicators in negative territory

- European households remain worried

- First sign that inflation is losing momentum

- ECB becomes the most aggressive central bank

- Decorrelation of rates and yields?

- The rise in yields is not over

- Securitised real estate still influenced by interest rates

- Attractive valuations for European equities