29

Jun

Favor real estate and equities over european bonds

Limited recession in 2023. Inflation surprises the ECB. End of restrictive cycle closer to 5%. Rising yield curves. Appreciation of the euro. Attractive valuations for securitized real estate and European equities.

Key points

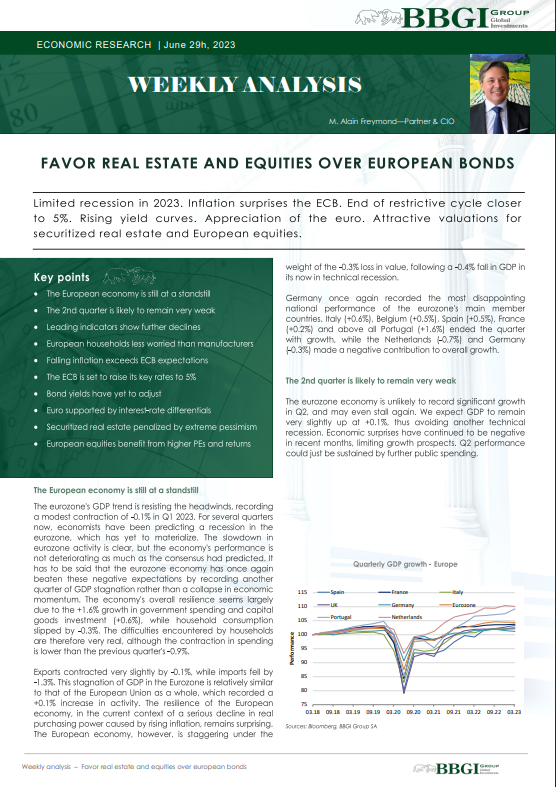

- The European economy is still at a standstill

- The 2nd quarter is likely to remain very weak

- Leading indicators show further declines

- European households less worried than manufacturers

- Falling inflation exceeds ECB expectations

- The ECB is set to raise its key rates to 5%

- Bond yields have yet to adjust

- Euro supported by interest-rate differentials

- Securitized real estate penalized by extreme pessimism

- European equities benefit from higher PEs and returns