30

Apr

Bonds markets still relatively unaffected by US interest rates at 3%

Higher expected inflation in the USA. Warning on the interest rate markets. The European cycle is still hesitating. Confederation yields finally settle above zero.

Key points

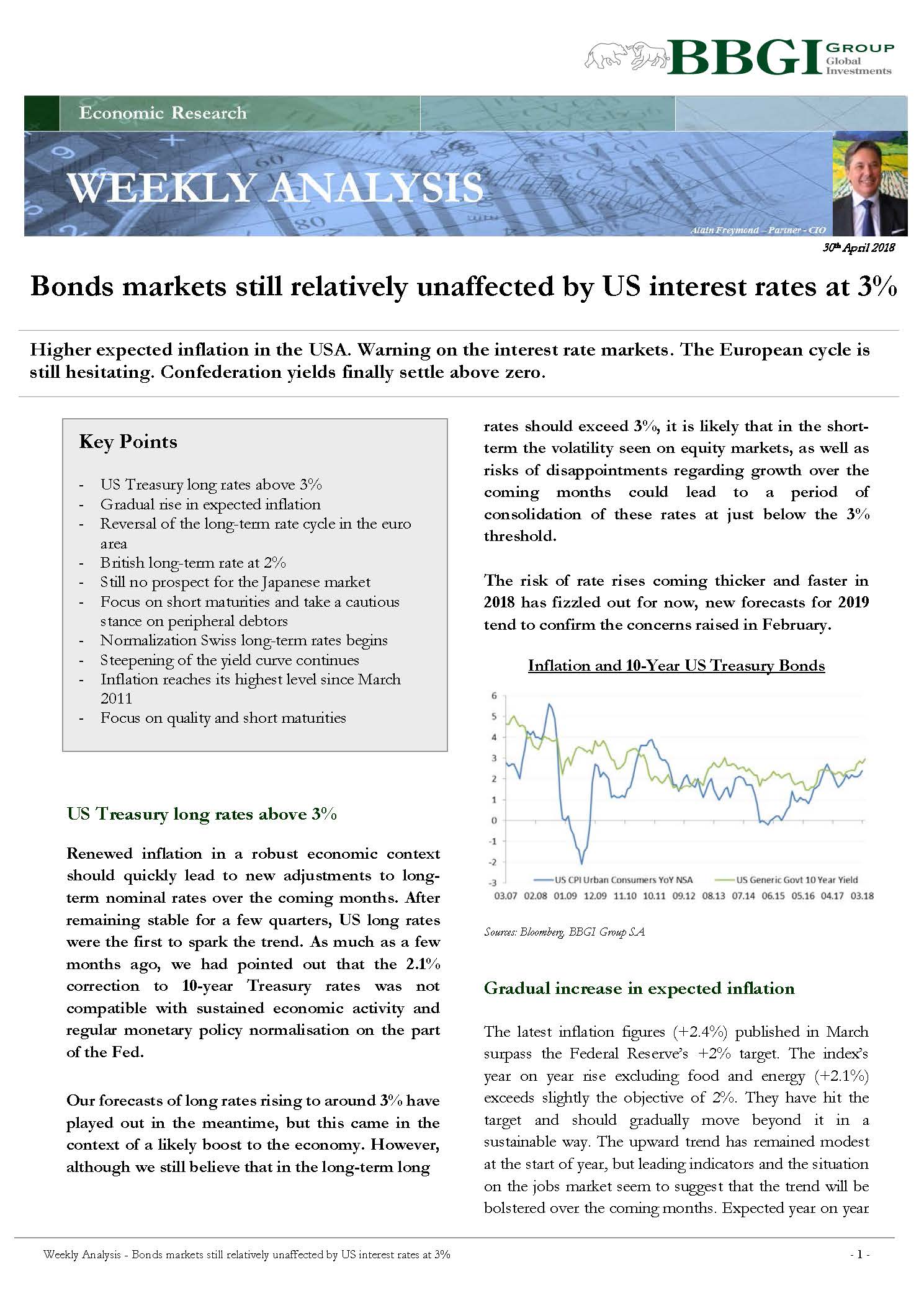

- US Treasury long rates above 3%

- Gradual rise in expected inflation

- Reversal of the long-term rate cycle in the euro area

- British long-term rate at 2%

- Still no prospect for the Japanese market

- Focus on short maturities and take a cautious stance on peripheral debtors

- Normalization Swiss long-term rates begins

- Steepening of the yield curve continues

- Inflation reaches its highest level since March 2011

- Focus on quality and short maturities