19

Dec

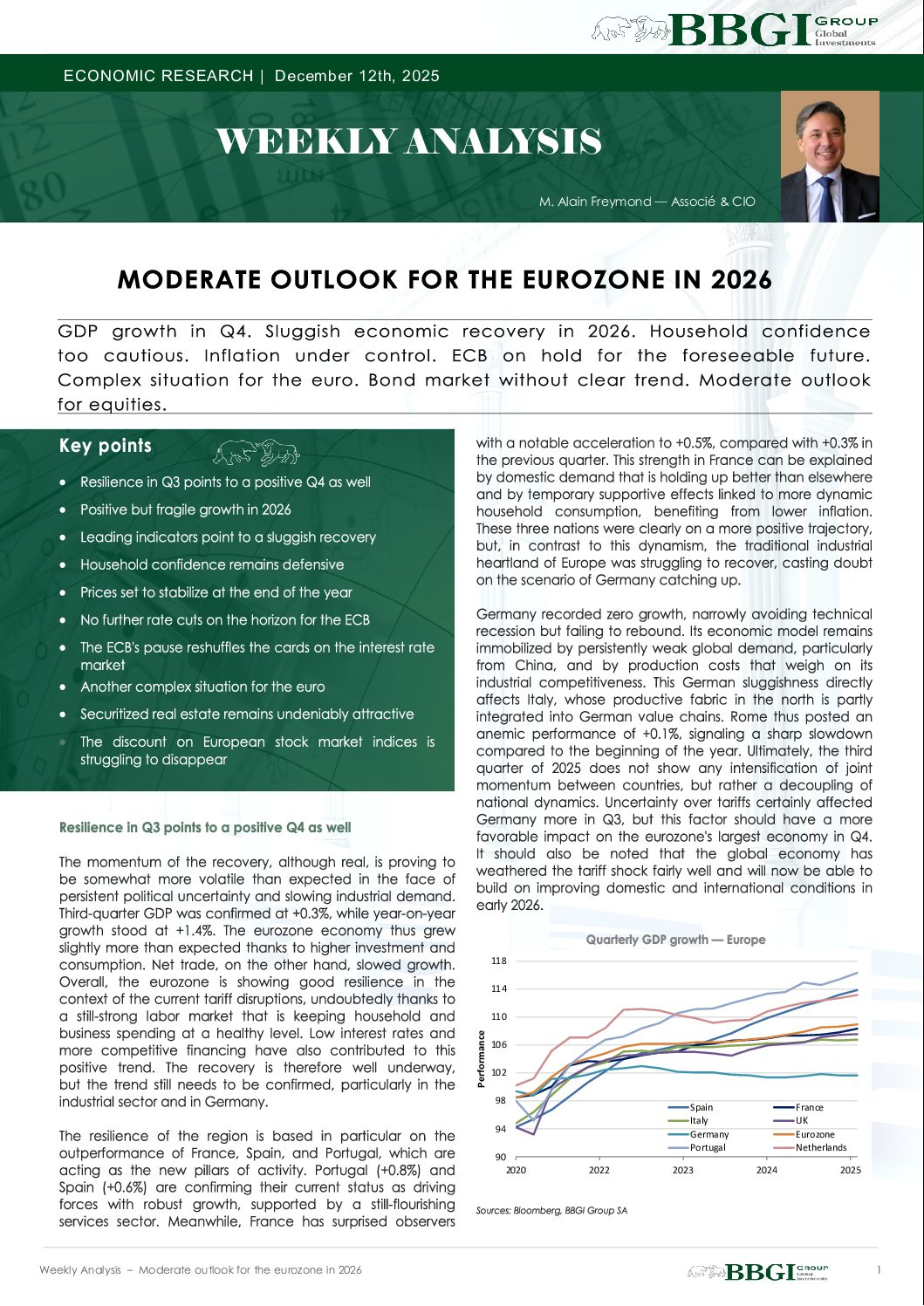

Moderate outlook for the eurozone in 2026

GDP growth in Q4. Sluggish economic recovery in 2026. Household confidence too cautious. Inflation under control. ECB on hold for the foreseeable future. Complex situation for the euro. Bond market without clear trend. Moderate outlook for equities.

Key points

- Resilience in Q3 points to a positive Q4 as well

- Positive but fragile growth in 2026

- Leading indicators point to a sluggish recovery

- Household confidence remains defensive

- Prices set to stabilize at the end of the year

- No further rate cuts on the horizon for the ECB

- The ECB’s pause reshuffles the cards on the interest rate market

- Another complex situation for the euro

- Securitized real estate remains undeniably attractive

- The discount on European stock market indices is struggling to disappear