03

Apr

The temporary fall in industrial metals is an opportunity

The risk of a “trade war” is overstated. A rise in customs duties will not reduce demand. Limited production, robust demand, falling inventories.

Key points

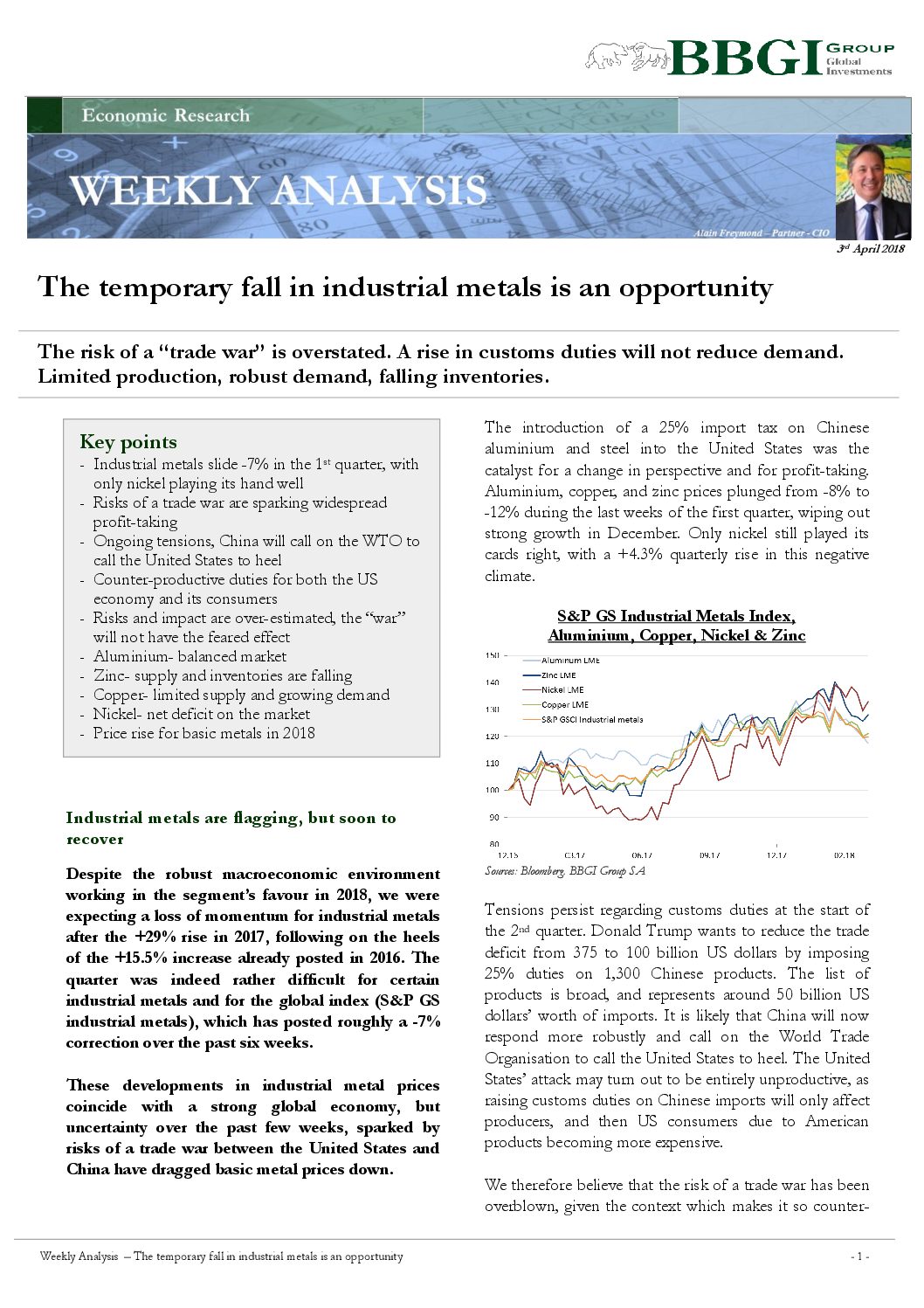

- Industrial metals slide -7% in the 1st quarter, with only nickel playing its hand well

- Risks of a trade war are sparking widespread profit-taking

- Ongoing tensions, China will call on the WTO to call the United States to heel

- Counter-productive duties for both the US economy and its consumers

- Risks and impact are over-estimated, the “war” will not have the feared effect

- Aluminium- balanced market

- Zinc- supply and inventories are falling

- Copper- limited supply and growing demand

- Nickel- net deficit on the market

- Price rise for basic metals in 2018