11

Dec

More attractive risk premium for US government debt

Economic momentum slows. Weakened employment and consumption. Priority to growth.

Unavoidable continuation of deficit monetisation. Rising earnings for equities.

Key points

- GDP momentum expected to slow sharply in Q4

- Employment remains fragile and could penalise

consumption. - The four priorities of the new US president

- Rising government deficit and risks of structural

depreciation of the US dollar - Post-Covid debt financing implies further

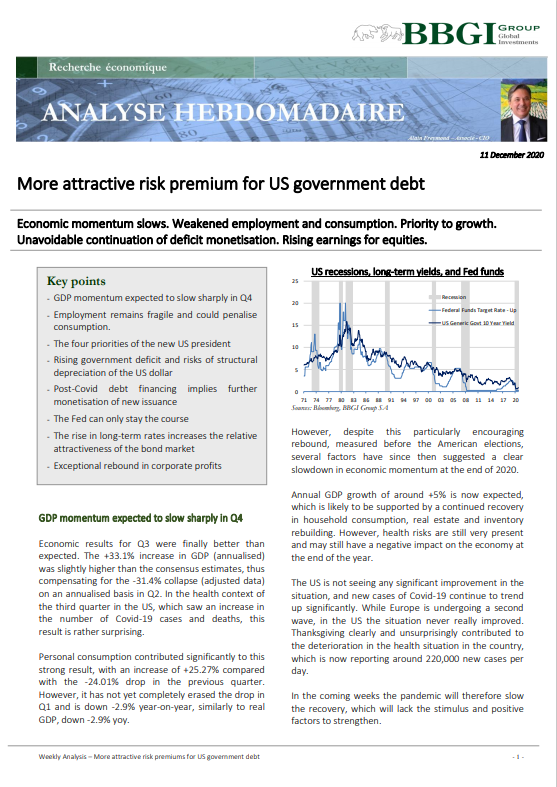

monetisation of new issuance - The Fed can only stay the course

- The rise in long-term rates increases the relative

attractiveness of the bond market - Exceptional rebound in corporate profits