26

Jan

A bearish start to the year for the capital markets

A Probable rebound for the long-term rates in 2021. Increase in the relative attractiveness of the U.S. market. Inflationary risks underestimated. Beware of risk premiums and durations.

Key points

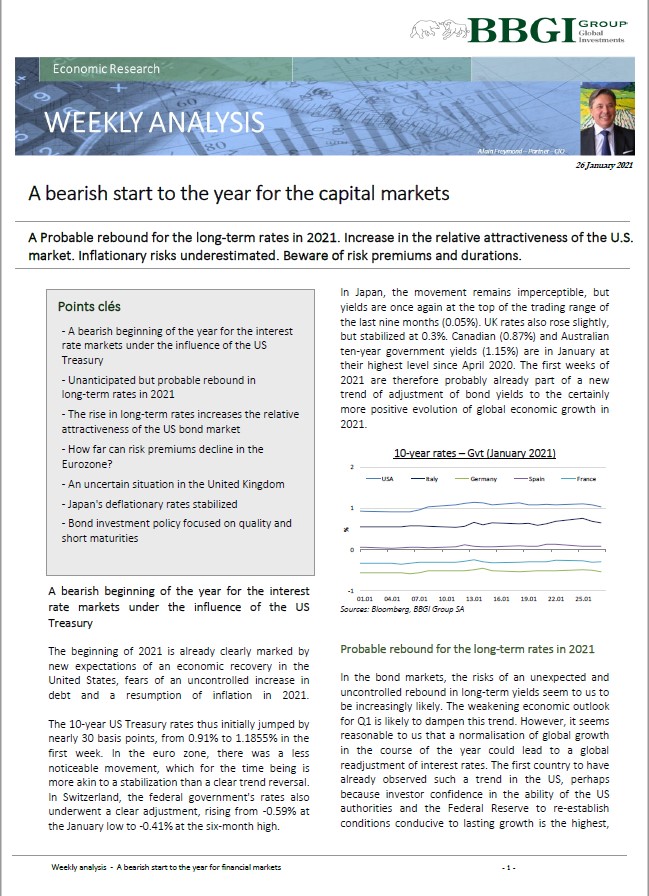

- A bearish beginning of the year for the interest rate markets under the influence of the US Treasury

- Unanticipated but probable rebound in long-term rates in 2021

- The rise in long-term rates increases the relative attractiveness of the US bond market

- How far can risk premiums decline in the Eurozone?

- An uncertain situation in the United Kingdom

- Japan’s deflationary rates stabilized

- Bond investment policy focused on quality and short maturities