17

Mar

SVB bankruptcy: a new paradigm in monetary policy?

The bankruptcy of the SVB has various consequences. The systemic risk seems to be ruled out by central banks. CS is a global systemic bank. SNB support was expected. A likely new paradigm for rates.

Key points

- Silicon Valley Bank (SVB) bankruptcy will affect US monetary policy

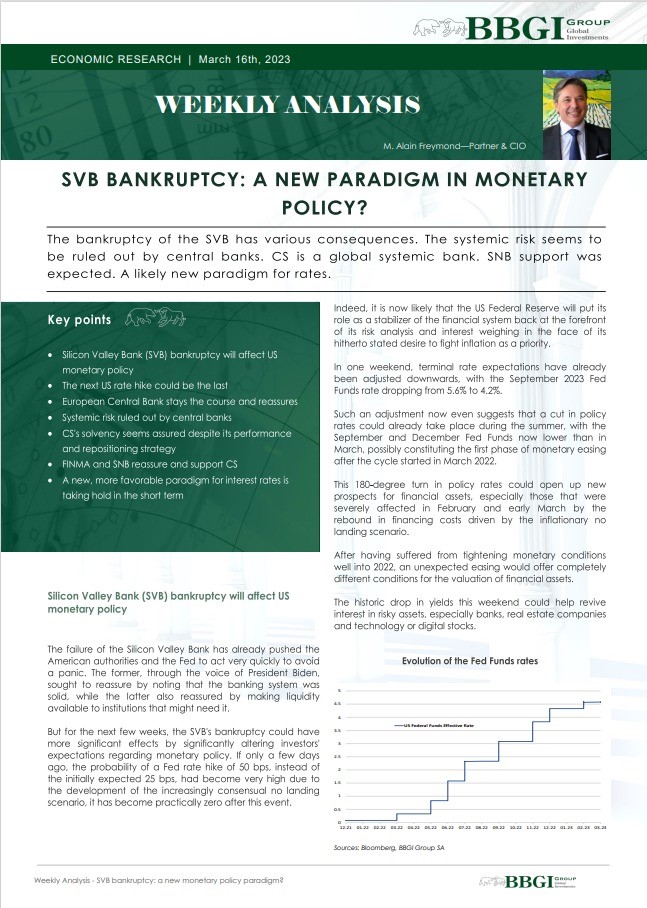

- The next US rate hike could be the last

- European Central Bank stays the course and reassures

- Systemic risk ruled out by central banks

- CS’s solvency seems assured despite its performance and repositioning strategy

- FINMA and SNB reassure and support CS

- A new, more favorable paradigm for interest rates is taking hold in the short term