03

Jan

100 BP cut in ECB rates in 2025

Resilient domestic demand. Potentially stronger Q4. Leading indicators still uncertain. Inflation stabilizing near +2%. ECB cuts 100 bps by 2025. Difficult situation for the euro. Opportunities in financial markets.

Key points

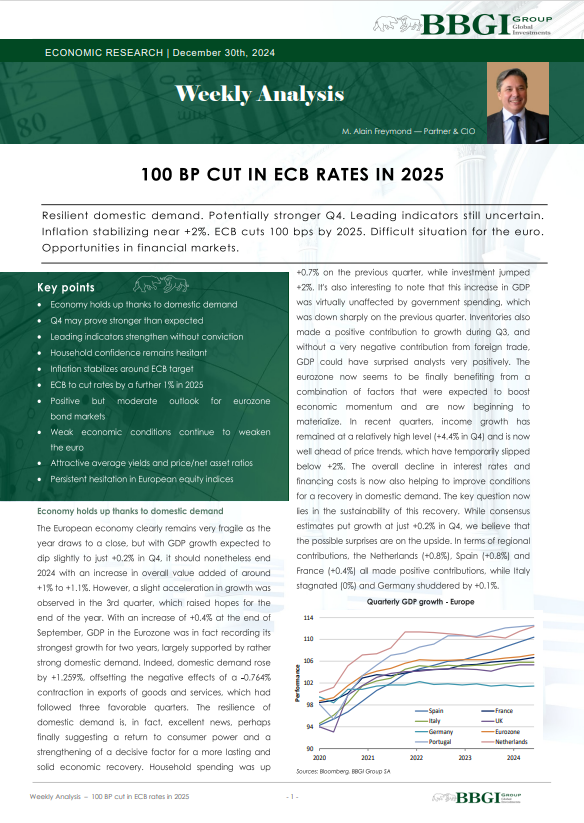

- Economy holds up thanks to domestic demand

- Q4 may prove stronger than expected

- Leading indicators strengthen without conviction

- Household confidence remains hesitant

- Inflation stabilizes around ECB target

- ECB to cut rates by a further 1% in 2025

- Positive but moderate outlook for eurozone bond markets

- Weak economic conditions continue to weaken the euro

- Attractive average yields and price/net asset ratios

- Persistent hesitation in European equity indices