Category: Weekly Analysis

06

Mar

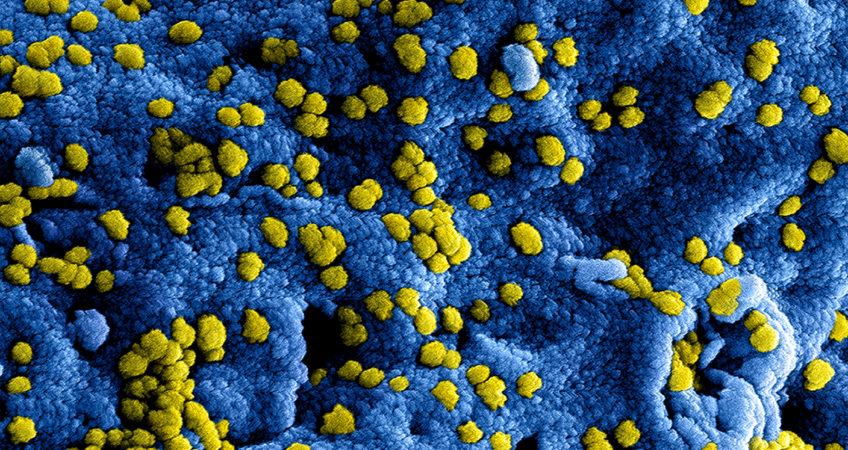

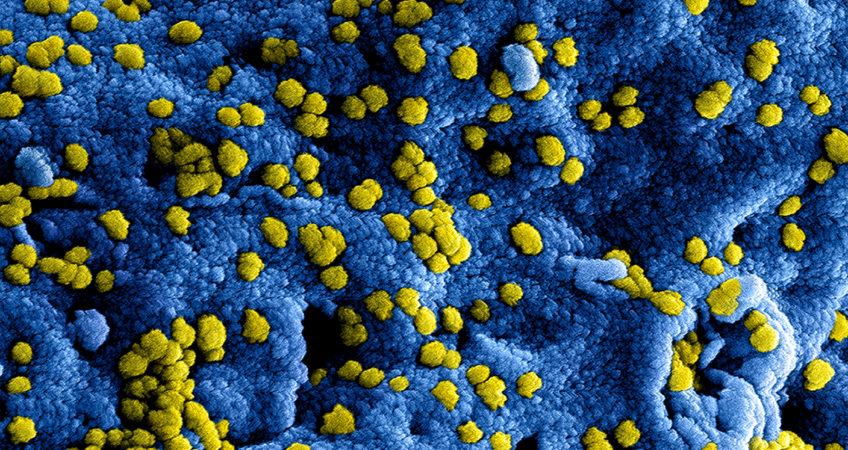

Covid-19 will also affect Switzerland’s GDP. As expected, the franc is in high demand in the short term. The growth outlook has deteriorated. Panic is finally impacting equities. Key points +0.3% growth in Switzerland in Q4 raised hopes of a good start to 2020 Growth was still driven by private and public consumption in Q4 [...]

10

Jan

400 billion in cash injections in Q4. Expansion or status quo in 2020? High earnings expectations. Extreme equity valuations. More risks than opportunities. Key points Massive and questionable cash injections in Q4 400 billion in new liquidity Why has the Fed intervened so massively? Dangerous interdependency between markets and monetary policy Financial markets gamble on [...]

06

Jan

Reduced trade tensions. Rising uncertainty relating to the elections. Resurgence of geopolitical risks. +2% GDP growth in 2020. Extreme equity valuations. Key points Real GDP growth of approximately +2.2% in 2019 and +2% in 2020 Risk of polarisation between the Democrats’ and Republicans’ political programmes Election year could prove turbulent for investors Growth in 2020 [...]

13

Dec

Conservatives win absolute majority. The path to Brexit is becoming clearer. Lower levels of uncertainty favourable to the pound. Long-term rates rise. BOE ready to cut rates. Key points British voters are done with political foot-dragging on Brexit Brexit will happen In a good position to negotiate a softer Brexit Although a technical recession was [...]

06

Dec

GDP up +0.2% in Q3. Germany holds out on the edge of recession. ECB maintains status quo. Change of outlook for long-term rates. Valuations in Europe’s favour. Key points Q3 slightly better than expected in the Eurozone Growth in Q3 driven by consumption, government spending and exports Leading indicators leave room for doubt Consumer confidence [...]

03

Dec

Anaemic GDP growth of +0.1% in Q3. Consumption slows. Exports contract. BOJ in holding pattern pending a government stimulus plan. Key points GDP growth in Japan ground to a halt in Q3 (+0.1%) Exports fell further, but the trade balance is once again showing a surplus Industrial output dipped again at year-end after showing some [...]

28

Oct

Nominal GDP has passed the CHF 700 billion per year mark. Equity valuations above their historical average. Clear overvaluation of the Swiss franc in terms of PPP. Key points Swiss GDP’s +0.4% growth rate in Q3 comes as a favourable surprise to forecasters Switzerland’s GDP exceeds CHF 700 billion per year for the first time [...]

26

Sep

GDP up +2.2% in 2019. Declining nominal and real rates beneficial to the economy. Leading indicators still wavering. Rebound in long-term rates. Beware of PE ratios. Key points Excessive pessimism unfounded but ultimately favourable to economic growth Nominal and real rates will support economic momentum The Fed confirms +2.2% GDP growth expectations for 2019 Economic [...]

24

Sep

GDP down -0.2% in Q2. Real risk of recession. Likelihood of no-deal withdrawal decreases. BOE in wait-and-see mode. Possible upswing of long-term sterling rates. Key points Boris Johnson’s strategy defeated by the Supreme Court Threat of a no-deal Brexit diminishes A technical recession might be avoided following the -0.2% decline in GDP in Q2 The [...]

19

Sep

GDP up +0.2% in Q2. Germany poses a problem. The ECB to inject 20bn/month for two years. Rebound of the euro. Asset rotation favourable to European equities. Key points Contraction of Germany’s GDP hampers growth in Europe Underlying trends in consumption and investment remain positive Leading indicators may have seen the worst and finally seem [...]